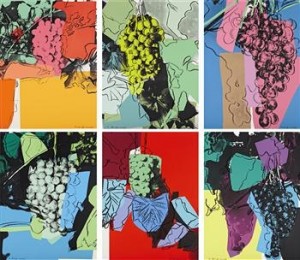

Pssst…Can we talk about money? I keep on getting press releases from Phillips de Pury about all the wonderful things they’ve sold, the auction records they’ve broken – Richard Prince’s “Cowboys and Girlfriends” portfolio fetching $146,500; Andy Warhol’s “Grapes” topping $104,500 – and the next pot of gold waiting in the auction markets in New York and London. And if it’s not from an auction house, the emails chime in from the art fairs in Abu Dhabi, Barcelona, Geneva or galleries in India, Hong Kong or some new white cube that just opened here in Paris.

Meanwhile Europe is flailing and talk of a euro collapse is now a bit of a broken record. The financial markets are whipsawed daily while the art market, on the eve of Art Basel Miami , steps around the see-saw and the swings and heads for the candy store where everything is shiny and new and all dressed up for the big lick.

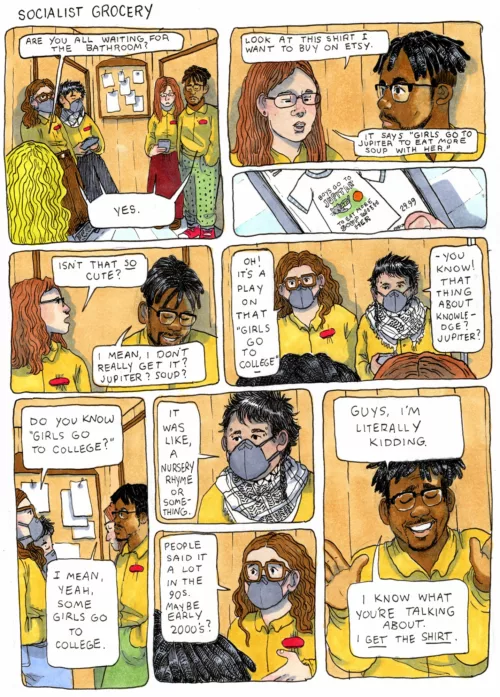

But there’s a disconnect going on – and there has been for quite a while. Anyone who seriously makes art has always felt the tug of war between what goes on in the studio and what goes on in the galleries. Work with paint, canvas, paper, wood, or video, and what you take in annually from these aesthetic investigations compared to what the blue chip artists pull in is undoubtedly a pittance. Yet the art world ticks on. Yes, we understand it’s all supply and demand, but there’s also hype and myth and probably price rigging. Recently a New York art dealer came to Paris and told me that he’s really only interested in working with artists whose works sell for at least $5000.

Clearly no parent in his or her right mind would encourage his or her art school child to attempt to earn a living as an actual artist. Better to become a baseball player; at least the odds seem better. (For the record there are fewer than 750 professional Major League baseball players and practically every boy and many girls entertain the fantasy of playing shortstop for the Yankees, or even the Phillies). Most artists are in the 99.9 percent category.

So along comes the OWS, the Occupy Wall Street phenomenon, the swelling ranks of the 99%, the disgruntled, often out-of-work folks gathering in New York’s Zuccotti Park and other public areas around the country and the world. What are they doing? Mostly grumbling about how the rich people are rich – and have great tax advantages! – and gosh darn it, they’re not and they don’t. If they were rich, would they have spent nearly two months in the Park?

Clearly the wealthiest slaves of capitalism – the investment bankers, hedge fund traders, the quants – have done pretty well since the financial tsunami hit the shores of New York and London and the rest of the capitalized world – wiping out trillions in wealth, killing home values, and putting friends and family out of work.

The OWS crowd though recently turned its ire to another ivory tower of privilege and wealth – The Art World – surrounding the entrance of MoMA a month ago and whining about ticket prices ($25) and the elitism of high-priced objects in the Museum’s collection. So, a quick vote, please check: Stupid [ ] Dumb [ ]. They could get an annual membership for $75 and come and go as they like. And support the museum in more fruitful ways than stopping traffic on W 53rd Street.

The OWS Art World splinter group is pissed off because…well, why? They don’t like supporting an institution that is world class and not on the government teat? Or because these protesters (artists) are not in MoMA themselves?

An acute artist-observer of the 99 per-centers takes umbrage with me over my vitriol: “I think it’s appropriate to criticize art institutions because they mainly support the 1% of artists and art collector class,” he writes. “And the commodification of that top 1% of art products to a hyped-up and overvalued object status is akin to what we have in the rest of society, particularly in the investment community. I believe the only way to prevent the masses from revolting and killing the rich is to have a buffer class, a middle class. So, you spread the wealth around; in my opinion, this is the role of government. Where is the 1% going to get their income from in the future if they’ve already taken it all from the 99%?”

Well, okay, then. Why not Occupy Julian Schnabel? Or better, Occupy Jeff Koons! Or heck, why not occupy The FIAC, the art fair in Paris? It would have been easier to occupy this year as the fair was reunited under a single, glorious roof: The oxidized copper struts and gleaming glass of The Grand Palais. However, 33 euros a pop (FIAC’s ticket price) to have the opportunity to pay $3 million+ for a collection of Damien Hirst’s fish might irritate the Occupy folks. In any case, you can download free Occupy posters made, one would believe, by the Occupy Artists, like the always controversial Shepard Fairey.

I have to admit I didn’t go to the FIAC this year, but I did stroll through the Tuilleries where several large-scale sculptures were on display during one of the most beautiful autumn days in Paris in my memory. Here’s a report about the FIAC in The New York Times : Sales were exceptionally strong despite the global economy swirling around in the “toilette.” Key quote: “Maybe we’re in a bubble.” – Nathalie Vallois, Georges-Philippe & Nathalie Vallois Gallery, Paris.

So last week, as I am ambling along rue Saint-André-des-Arts, between St Michel and Odéon in Paris, I pull into a retail store called Carré d’artistes, one door down from a Starbucks. Their slogan (above the door) is for the 99 percenters: “L’art pour tous en grand format.” (Art for everyone in large sizes). There were four artists on view – one who sticks things on canvases, another who schmeers paint, another who does a Latin number in a surreal portrait style and the last who knocks out cityscapes that capture, in thick globs of paint, the movement of yellow taxis and wet pavement. It was all horrible, but hey it came in five sizes, and three prices, right up to 3000 euros. I asked one of the half dozen sales girls if on this day, a Sunday, anything sold. “Oh yes, we sold five works today.” I couldn’t imagine anyone buying anything there, but that’s a pretty good day, I imagine, in any art gallery.

FYI, here’s the “concept” announced on their site: Our ambitions Liberate Art ! Carré d’artistes® is the crazy gamble of art lovers whose ambition is to revolutionize a market previously inaccessible and compartmentalized, and to become a major actor in that market. The self-service exhibition spaces of Carré d’artistes® do away with any distance, or any intermediary, between the spectator and the artwork. By presenting all the artists on an equal footing, Carré d’artistes® shakes up the traditional rules. It is an alternative that democratizes contemporary art, and a generous undertaking that is respectful of the artists.

Maybe we’re not in a bubble. Recently I had a phone conversation with the folks at London-based The Fine Art Fund, an investment group that uses art as an asset class for profit. Its CEO, Phillip Hoffman, who famously doesn’t collect art himself says : “The world’s rich are putting their money into art.” He said it here.

Launched in 2004, The Fine Art Fund is one of several new investment instruments that seeks to take a hard asset like art (it could be real estate or gold or teak wood futures for all that matters) and hold it for a time period until there’s interest enough to sell it for a profit. The track record is actually pretty good according to Ruth Knowles, the Director of Global Marketing & Business Development at The Fine Art Fund. While the private equity group remains tight lipped regarding most everything – until, of course, you invest the minimum $250,000 – the group reported more than 25 percent returns on one of their investment venues and better than that on others. And at the end of the 10-year run investors earned before management fees about six percent or better on their investment, and notably for The Western Art Fund the annualized return of 33% on works sold.

While The Fine Art Fund incubates the value of works, investors can “borrow” the paintings to hang on their walls. You just have to pay for the privilege. For the Fine Art Fund II, the minimum investment is $250,000; for the Chinese Fine Art Fund, the minimum investment is $100,000. As a shareholder, can publicize your savvy with an original Matisse in your study.

“We don’t speak about the names of the artists we have in our portfolio,” explains Morgan Long, Director of Art Investment at The Fine Art Fund. She explained however that the composition of the portfolio is “35% Old Masters, 15% Impressionist, 15% Modernist and the balance in Contemporary. Old Masters are very much in demand and they are not correlated to the rise and fall of the stock market… Contemporary art, though, is highly risky asset.”

So who’s hot? Who should the Occupy Art World folks be fuming at? Morgan Long wouldn’t exactly say which artists the fund is buying but in mentioning Damien Hirst, and his 1990s stuffed and sliced horses, sharks and sheep, you’ve got a long term holding. She indicated that these works are “unique, iconic works,” adding: “I don’t think anyone disagrees that he’s the most important artist of his generation. Tate Museum will do a major retrospective during the London Olympics and that will bump up his…I would put my money into these unique 1990 works…they are consistently high.”

What to do? Don’t look at your 401k account and let go the creeping feeling we’re all going down the proverbial krapper. As much as artists want to maintain some aesthetic integrity – and their dealers some kind of cash flow – it’s pretty clear that only the bluest of the blue chippers can maintain and increase their values as well as the distance (in dollars) between themselves and the rest of the pack. So while few artists like talking about money, dinero, dinars and dollars are what make the world go round. However seeing your own art star rise and zeroes added to your prices is another kettle of fish; complaining about your occupying art world career won’t get the pot to boil. Better to haul down those Old Master paintings your grandmother bought 70 years ago and call up Christie’s to come take a look. Then take your profits and get yourself a MoMA membership. For most artists (and dealers), now is a great time to be poor. Isn’t it? Real artistic creation has nothing to do with creature comforts. Think Van Gogh, think early Pollock, think early de Kooning, think early Me.